portability estate tax return

An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an appointed executor of that same decedents estate on an estate tax return filed on or before the due date of the return including extensions actually granted.

Exploring The Estate Tax Part 2 Journal Of Accountancy

It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away.

. Consider state portability options. 2017-34 extends the time under certain circumstances to file an estate tax return to make a portability election. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months.

Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return. This term refers to the ability to transfer that unused portion to the surviving spouse referred to as the deceased spouses unused exemption DSUE. Since the value of the estate is below the exclusion amount an estate tax return would not normally have to be filed a short form was proposed for those taxpayers who are only filing to satisfy portability requirements but.

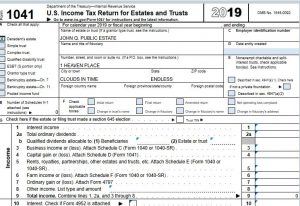

Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process. An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the. If the executor timely files the decedents Form 706 United States Estate and Generation-Skipping Transfer Tax Return which generally is due nine months after the.

The executor makes the portability election by filing a federal estate tax return for the first deceased spouse. Portability is only available to married couples. The amount of the estate tax exemption that was not used for the deceased spouses estate can be transferred to the surviving spouse if the first spouse dies and the value of their estate doesnt use up all the exemption.

Most states do not have an estate tax and only a couple allow for portability. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make. To obtain a portability election extension they can file a complete Form 706 by January 2 2018 or the second anniversary of the decedents death whichever is later.

If you dont file the 706 at the first death you cannot elect to port over this remaining amount. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021. I always like to review the Form 706 with the estate attorney to make sure that nothing is missed.

This portability election increases the total exclusion available to the surviving spouse by the amount of the deceased spouses unused exclusion. In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return. 2010 c 5 a.

This transfer is accomplished by completing the election on the Form 706 Estate Tax Return and can be completed without regard to the legal ownership of each spouse. 2017-34 to elect portability under Sec. When filing the taxes its important to select the portability election to have the benefits transferred to the surviving spouse.

The estate tax return must include a note at the top stating that it is filed pursuant to Rev. Portability is a federal exemption. In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the Maryland estate tax.

Form 706 is due on or before nine months after the deceased spouses date of death but an automatic six-month. Portability is the term used to describe a new provision in federal estate tax law that allows a widow or widower to use any unused federal estate tax exemption of his or her deceased spouse to shelter assets from gift tax during the surviving spouses life and estate tax at the surviving spouses death. The surviving spouse can use the deceased spouses unu.

For the DSUE to be usable by the spouse a complete and properly prepared estate tax return must be filed and portability must be checked on that tax return. The Impact of the Portability of the Federal Estate Tax Exclusion Example 1. Estate tax return preparers who prepare a return or claim for refund which reflects.

Review Form 706 with estate attorney. Calculating the DSUE is simple. If however a federal estate tax return is not required to be filed only then can a separate election be made for New York purposes similarly reflected on a pro forma federal return.

To properly make the portability election the surviving spouse must timely file a federal estate tax return known as the United States Estate and Generation-Skipping Transfer Tax Return or Form 706 for short. To claim estate tax portability the estate tax representative must file an estate tax return within 9 months of the first spouses death. The federal estate tax law was amended in 2013 to permit the executor of the estate of the first deceased spouse to give any unused unified credit to the surviving spouse.

This is called portability. The problem arises when we consider portability. The IRS thankfully has made electing portability easy.

This should only be addressed to ensure that state estate tax returns are filed if applicable. Available only for federal estate tax purposes portability was made permanent. If the estate needs more time to file for portability they can apply for a 6-month extension.

The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months. What Does Portability of the Estate Tax Exemption Mean. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the.

Portability was designed to minimize the harsh impact estate. Thanks to portability the surviving spouse can use the deceased spouses unused estate tax exemption and add it to their own when the surviving spouse passes away. Proc 2017-34 issued in part due to the considerable number of.

Special Rule Of Regulations Section 20 2010 2 A 7 Ii Trust Me I M A Lawyer

Will My Executor Be Required To File An Estate Tax Return Vermillion Law Firm Llc Dallas Estate Planning Attorneys

File Form 706 Federal Estate Tax Return By Patti Spencer Estategenie Blog

Form 706 Extension For Portability Under Rev Proc 2017 34

2017 Form Irs 706 Fill Online Printable Fillable Blank Pdffiller

Properly Preparing The Form 706 Estate Tax Return A 2 Part Series Ultimate Estate Planner

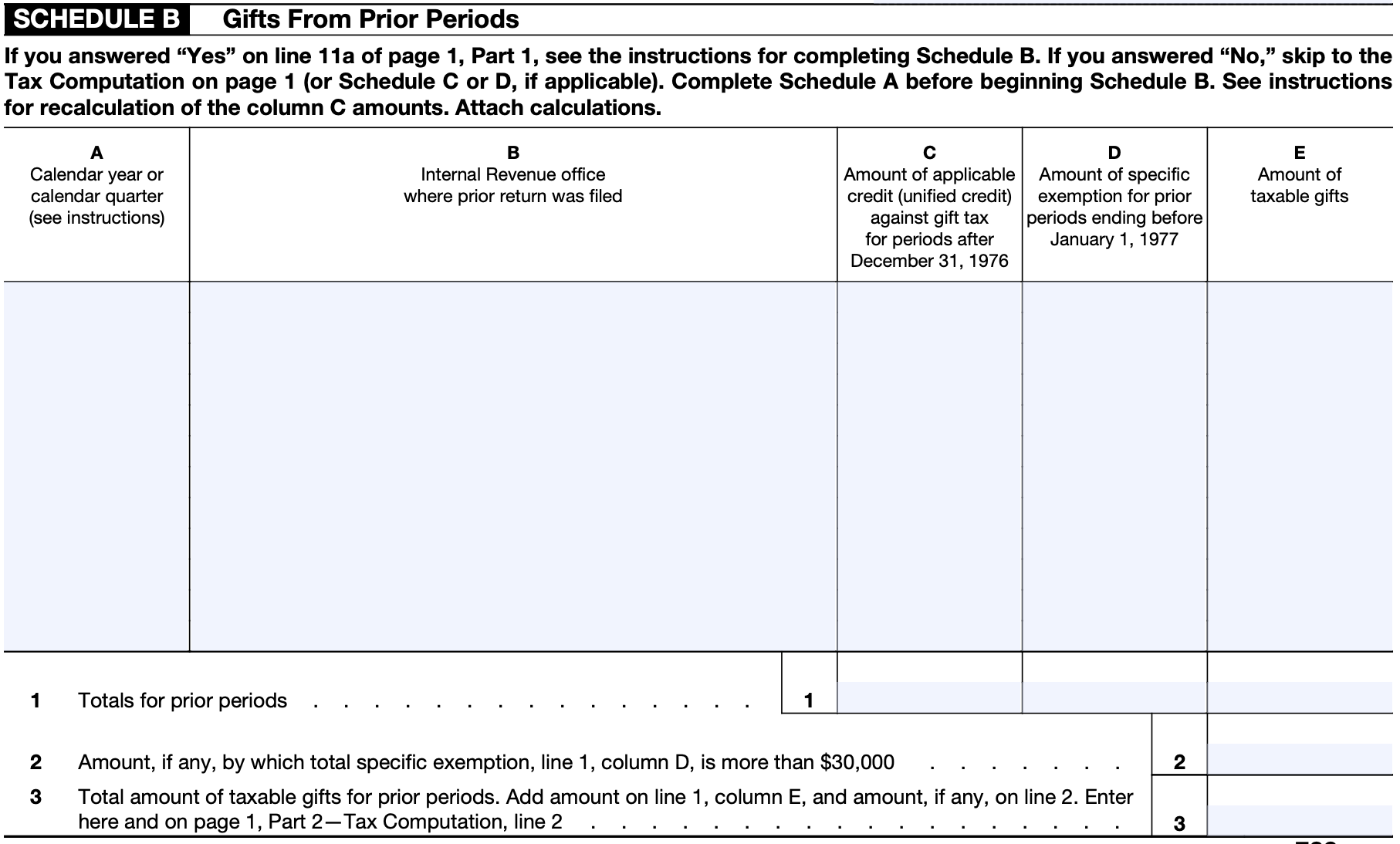

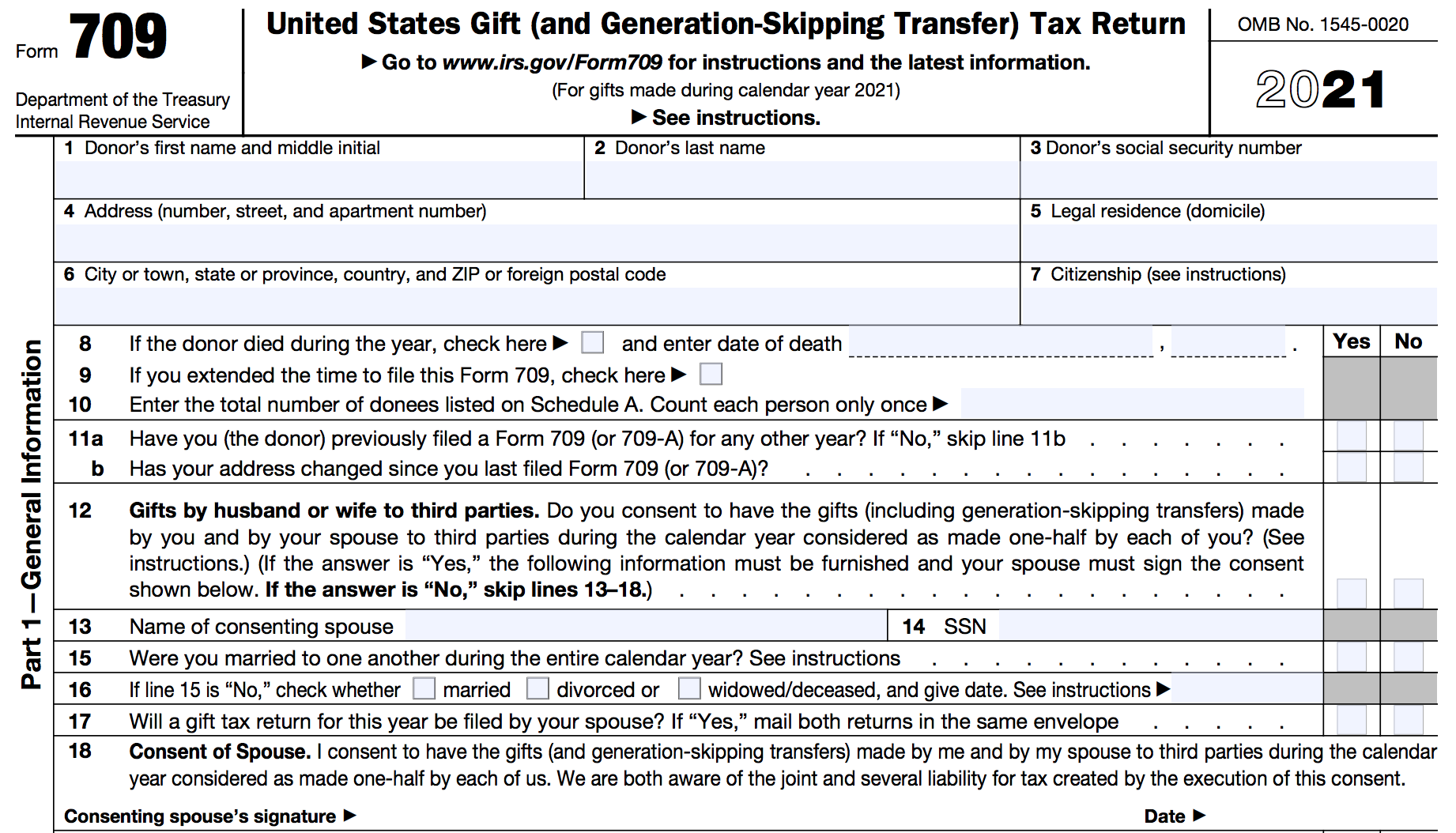

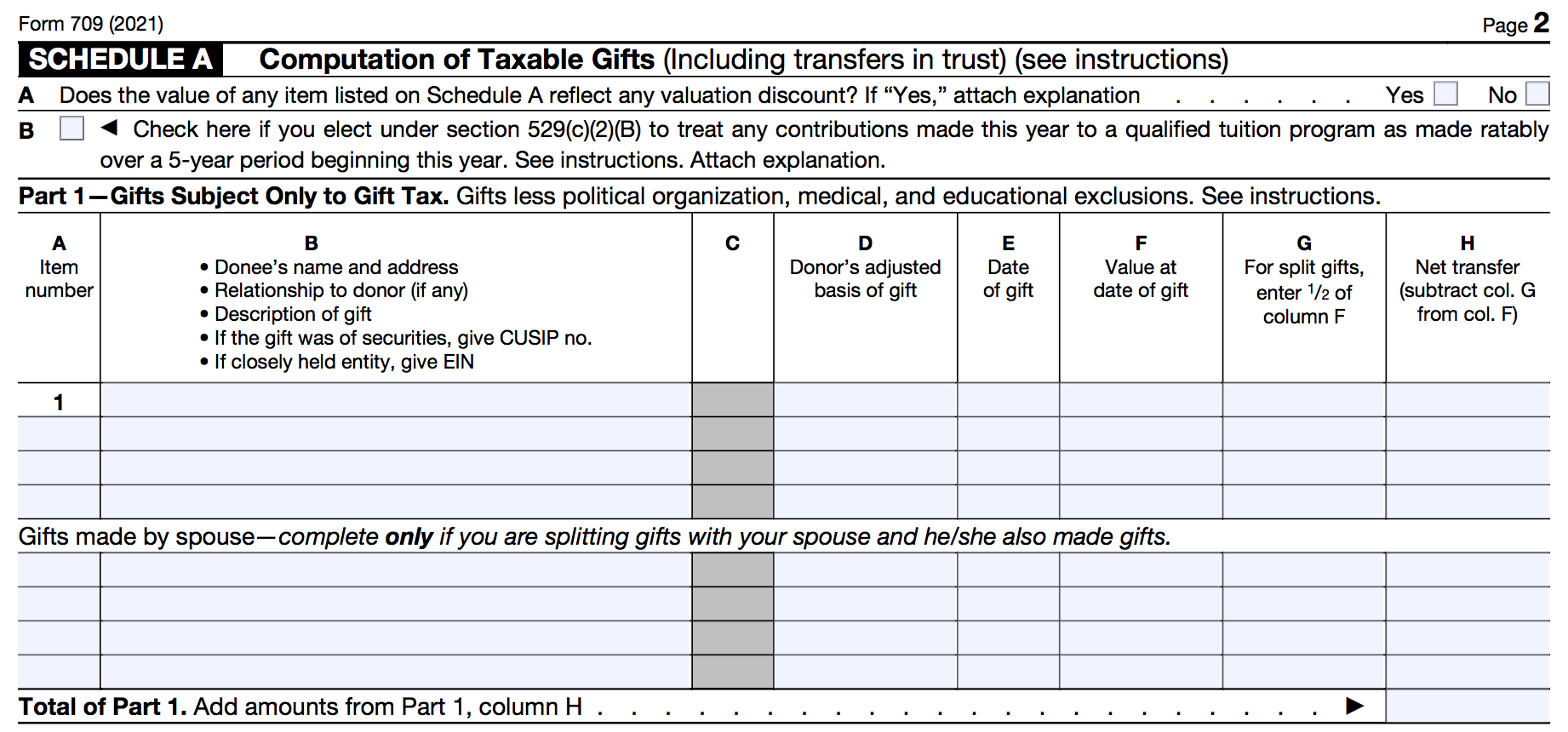

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Estate Tax Return Form 706 Trust Me I M A Lawyer

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

Philadelphia Estate Planning Tax Probate Attorney Law Practice Limited To Business Corporation Law Tax Probate Estate Administration Wills Trusts Estate And Trust Tax Return Preparation

Deceased Spousal Unused Exclusion Dsue Portability

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition